Present value of lump sum calculator

That means the party can take a single lump sum settlement of 36K today and have the. The present value comes in useful too.

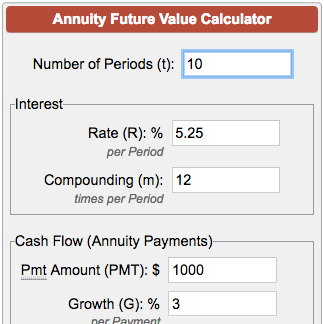

Future Value Of Annuity Calculator

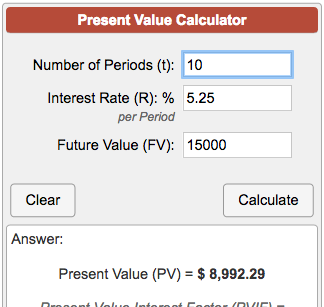

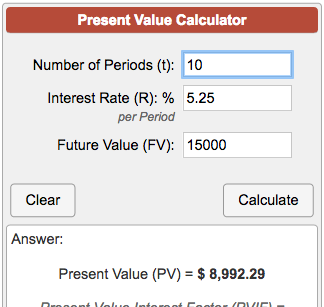

Using the Online Calculator to Calculate Present Value of Cash Flows.

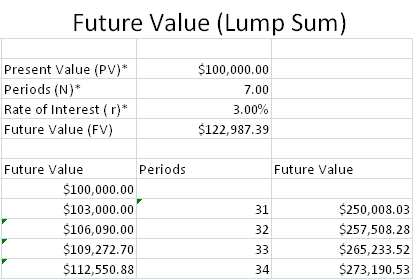

. The present value will depend on the expected rate of return. If you calculate youll see that the FV is 53928. Its called the ultimate retirement calculator because it does everything the others do and a whole lot more.

This is a more general concept than the insurance product that most people think of when they see the word annuity. Enter the dollar amount as the future lump sum. Related Retirement Calculators.

When is the present value of annuity calculated. What is the formula for calculating the present value of an annuity. The present value of any future value lump sum and future cash flows payments.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by David is 20882 and 20624 in case the payments are received at the start or at the end of each quarter respectively. The monthly pension will stand reduced by the portion commuted and the commuted portion will be restored on the expiry of 15 years from the date of receipt of the commuted value of the pension.

The time value of money is among the factors considered when weighing the opportunity costs of spending rather than. It may be seen as an implication of the later-developed concept of time preference. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate.

The net present value calculates your preference for money today over money in the future because inflation decreases your purchasing power over time. The annuity may be either an ordinary annuity or an annuity due see below. Or you want to receive a lump sum of 55k now.

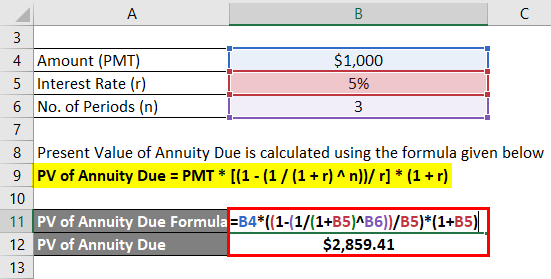

Present Value of Annuity Due Formula Table of Contents Formula. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. Pension Commutation Factor Calculation and Benefits.

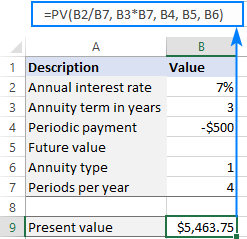

For example it can help you determine which is more profitable - to take a lump sum right now or receive an. PV formula examples for a single lump sum and a series of regular payments. This is a special instance of a present value calculation where payments 0.

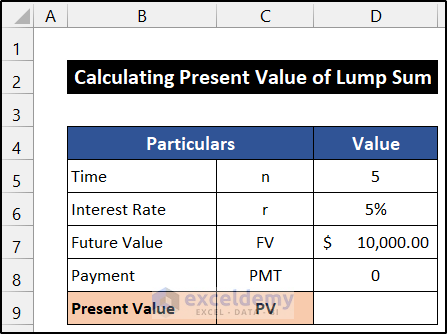

Lump-sum payable is calculated with reference to the Commutation Table. Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. Enter it as a percentage value ie.

The present value and future value of a dollar is a lump sum payment. Get 247 customer support help when you place a homework help service order with us. To include an annuity use a comprehensive future value calculation.

A series of equal lump sum payments over equal periods of time is called an annuity. Future cash flows are discounted at the discount. Present Value Of An Annuity.

Annuity Payment Calculator helps you decide if receiving a lump sum of money is more beneficial than an annuity. Ultimate Retirement Calculator. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Present value is the sum of money that must be invested in order to achieve a specific future goal. If the interest rate is not high enough to match the total. The present value of an annuity is based on a concept called the time value of money.

An investor needs to enter the lump sum or one time investment amount. Future value is the dollar amount that will accrue over time when that sum is invested. A mutual fund one time investment or lumpsum calculator provides the maturity amount for a given present value lump sum investment.

11 instead of 11. Assuming that you can safely withdraw 4 of a portfolio annually without touching the principal I would need a portfolio of approximately 390000 in 2046 to withdraw. Calculate the future value return for a present value lump sum investment or a one time investment based on a constant interest rate per period and compounding.

It provides the value of the wealth gained during the tenure of investment for the amount invested at the beginning of the period. The present value of an annuity is the lump sum amount that would need to be invested today to receive a fixed series of payments in the future. An annuity can be defined as an insurance contract under which an insurance company and you enter into a contractual agreement whereby the user receives a lump sum amount upfront in lieu of series of payments to be made at the.

Generally the option with a higher present value is the better deal. According to the Harvard Business School the theory behind the time value of money is that an amount of cash is worth more now than the promise of that same amount in the futurePayments scheduled decades in the future are worth less today because of uncertain economic conditions. The tutorial explains what the present value of annuity is and how to create a present value calculator in Excel.

Thus this present value of an annuity calculator calculates todays value of a future cash flow. Present Value - PV. What is Present Value of Annuity Due Formula.

Use the interest rate at which the present amount will grow. I the one-year prohibition on seeking or accepting employment or any form of compensation or financial benefit from any contractor or vendor with whom a former staff member has had personal. The calculator discounts the annuity to a present value so that you can compare which option is the better deal.

Present Value Discount Rate. PV C 1 1r n r 3. The present value is the total amount that a future amount of money is worth right now.

The PV is 36465. The present value of an annuity formula is. Fifth Third Banks Lump Sum vs.

Generally people tend to go for the first option as the money invested right now can earn interest. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money. To calculate the future lump sum amount that equates to receiving 1300 a month I first tallied up the yearly value of the payments which is equal to 15600 1300 x 12.

Using the Present Value Calculator. It includes loans interest payments from bonds even the annuity. If you want to calculate the present value of a stream of payments instead of a one time lump sum payment then try our present value of annuity calculator here.

Future Amount The amount youll either receive or would like to have at the end of the period Interest Rate Per Year Discount Rate The annual percentage rate investment return youd earn over the period of your investment Number of Years The total number of years until the future sum is received or the total number of years until. The future cash flows of. The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates.

The amount of money you have to invest now in order to reach your lump sum goal in time. Present Value of Money. Present Value Formula and Calculator.

Calculating Present Value Accountingcoach

Present Value Of A Single Cash Flow Finance Train

Using Pv Function In Excel To Calculate Present Value

Present Value Of Cash Flows Calculator

Tvm Calculator Archives Double Entry Bookkeeping

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

Present Value Calculator Basic

Present Value Formula And Pv Calculator In Excel

Present Value Of An Annuity How To Calculate Examples

Present Value Of A Lump Sum In Excel Youtube

Present Value Of A Lump Sum Single Amount Financial Calculator Sharp El 738 Youtube

Present Value Of A Lump Sum Calculator Double Entry Bookkeeping

Lump Sum Discount Rate Formula Double Entry Bookkeeping

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Formula And Pv Calculator In Excel

Present Value Calculator

Future Value Of A Lump Sum